December Monthly Skinny Video

Weekly Market Report

For Week Ending January 24, 2026

For Week Ending January 24, 2026

U.S. new-home sales rose 18.7% year-over-year in October, reaching a seasonally adjusted annual rate of 737,000 units, according to long-awaited data from the U.S.Census Bureau. On a monthly basis, sales were essentially flat, dipping just 0.1% from September’s 738,000 units. The median new-home sales price fell 3.3% month-over-month to $392,300, down 8% from October 2024.

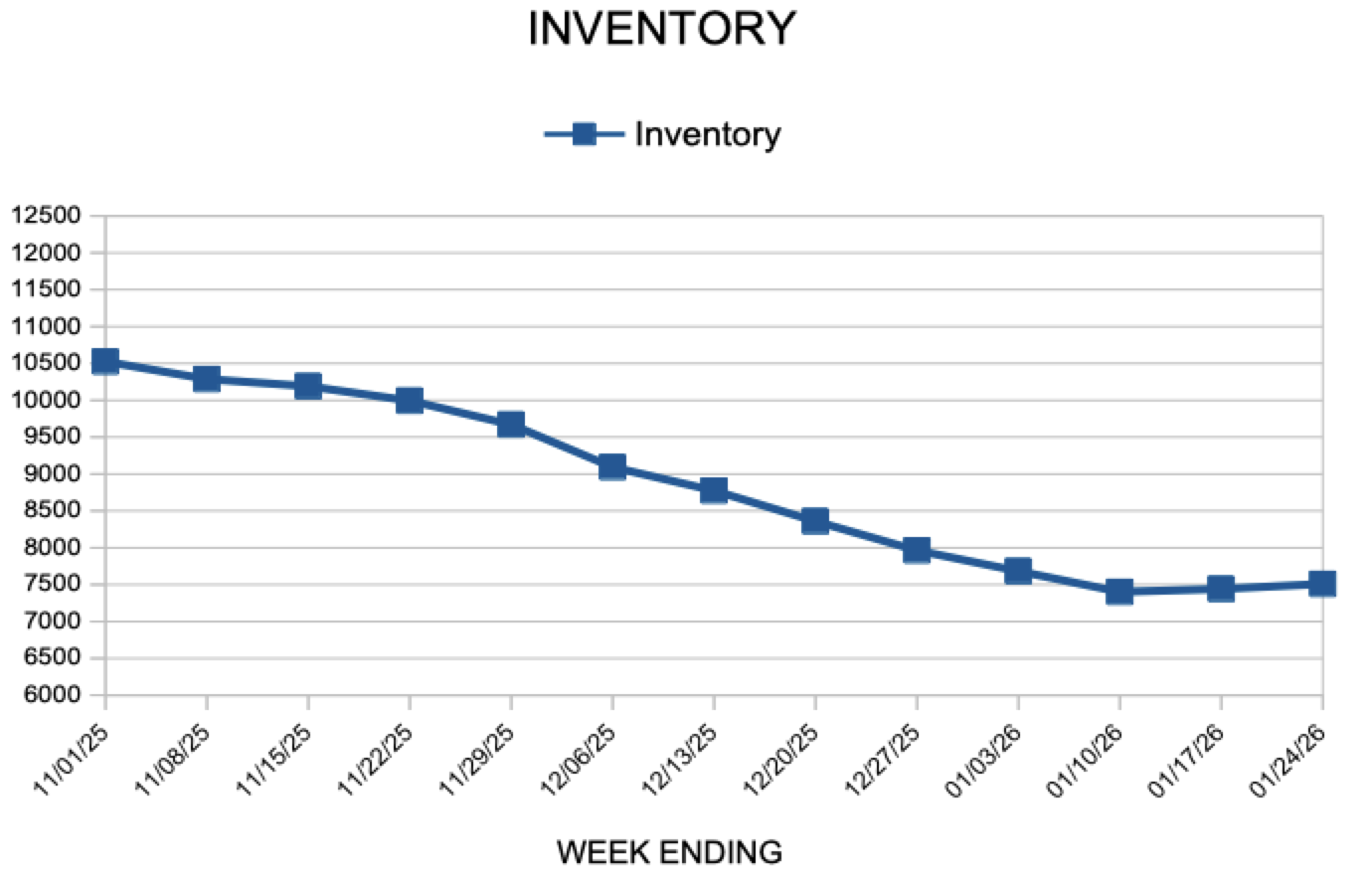

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 24:

- New Listings decreased 11.2% to 806

- Pending Sales decreased 5.6% to 571

- Inventory decreased 0.3% to 7,510

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 3.6% to 58

- Percent of Original List Price Received decreased 0.2% to 96.8%

- Months Supply of Homes For Sale remained flat at 2.0

All comparisons are to 2025

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

Mortgage Rates Remain Lower and Steady

January 29, 2026

Mortgage rates remain near their lowest levels in three years, which is encouraging for potential homebuyers who have waited to enter the market for some time. Lower rates, combined with strong income growth, have led to a steady increase in purchase applications compared to last year. More homeowners refinancing their mortgages are also benefiting from these lower rates, as shown by the rise in refinance applications over the past year.

- The 30-year fixed-rate mortgage averaged 6.10% as of January 29, 2026, up slightly from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 6.95%.

- The 15-year fixed-rate mortgage averaged 5.49%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.12%.

Information provided by Freddie Mac.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 120

- Next Page »