September 5, 2024

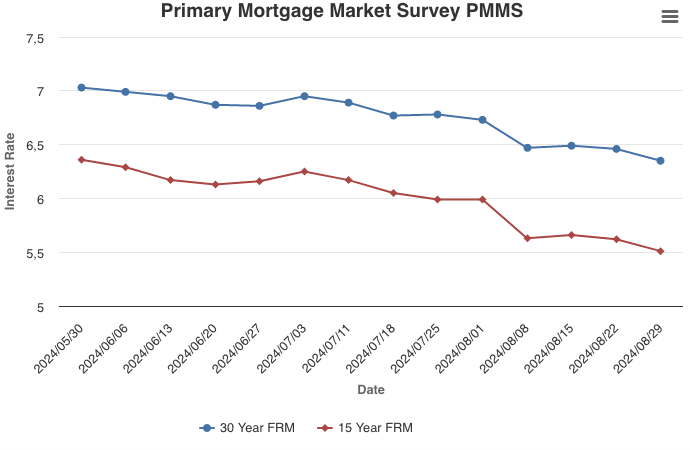

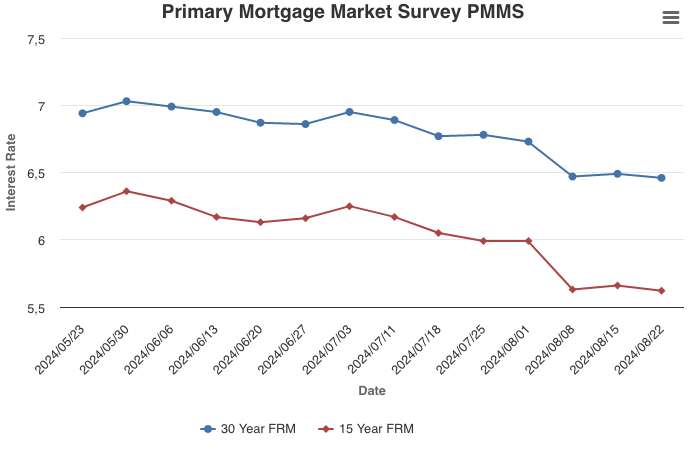

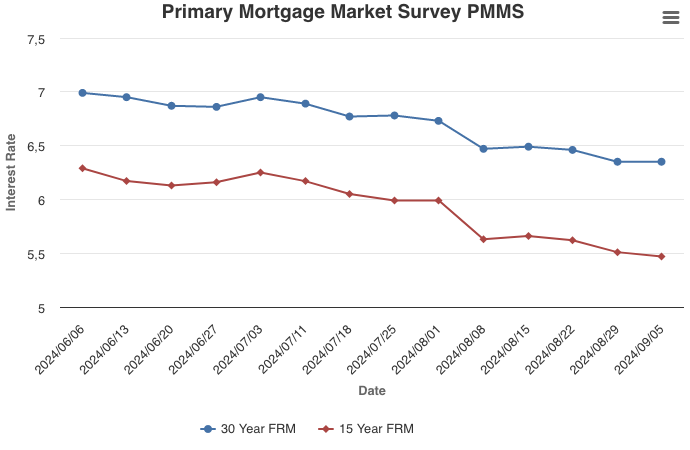

Mortgage rates remained flat this week as markets await the release of the highly anticipated August jobs report. Even though rates have come down over the summer, home sales have been lackluster. On the refinance side however, homeowners who bought in recent years are taking advantage of declining mortgage rates in order to lower their monthly payments.

Information provided by Freddie Mac.

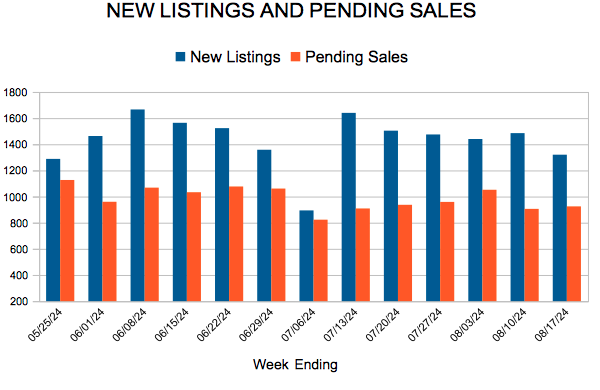

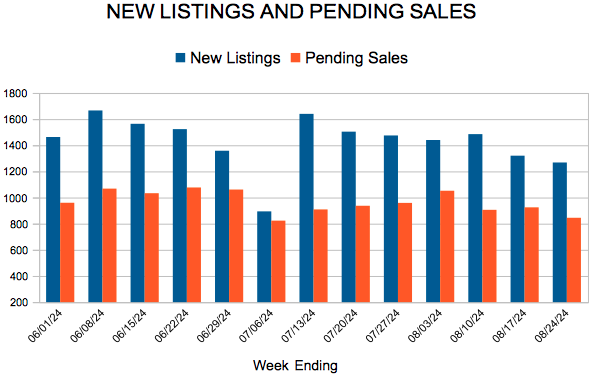

For Week Ending August 24, 2024

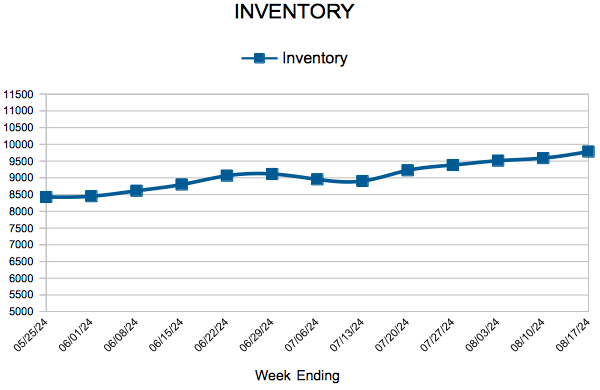

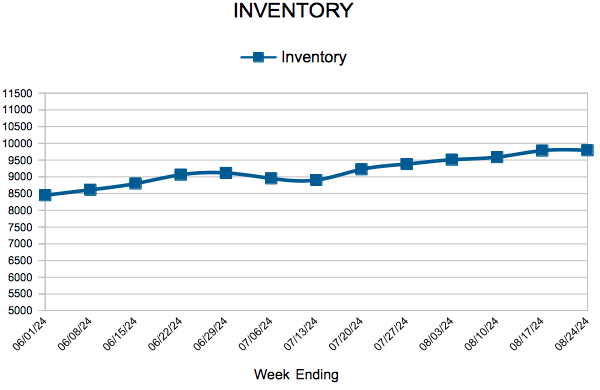

For Week Ending August 24, 2024