For Week Ending January 7, 2023

For Week Ending January 7, 2023

Fannie Mae recently announced changes to its automated underwriting system intended to simplify the loan process and help create more homeownership opportunities for underserved borrowers lacking an established credit history. The changes include updating eligibility criteria for loans where borrowers do not have a credit score, using borrowers’ bank statements to determine cash flow and balance trends, and providing an automated option for lenders to document nontraditional credit sources.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 7:

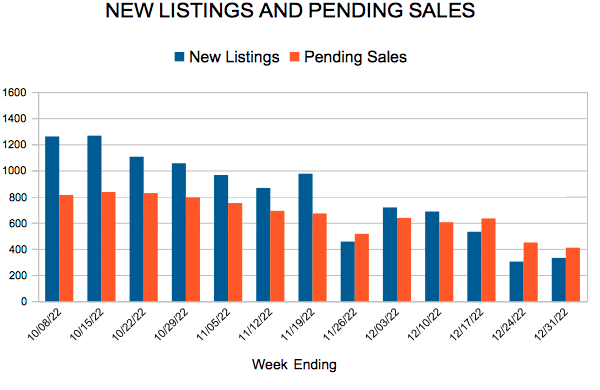

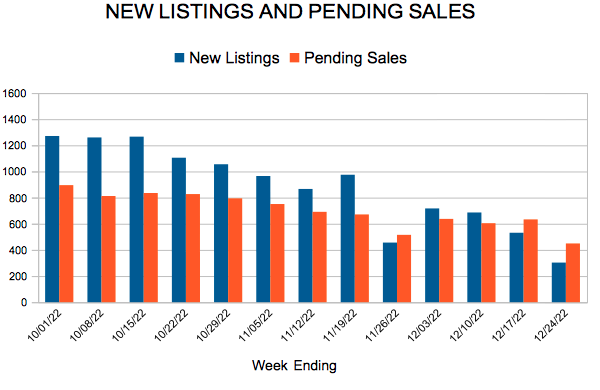

- New Listings decreased 5.3% to 808

- Pending Sales decreased 30.5% to 386

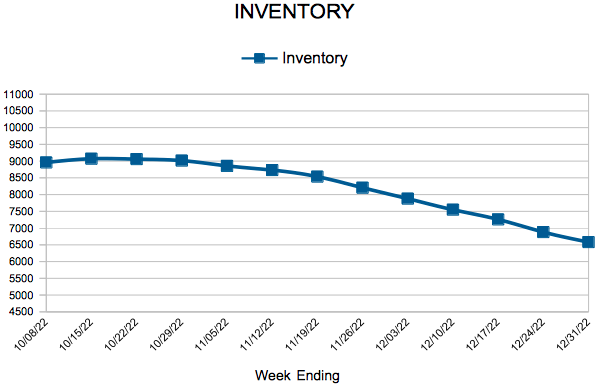

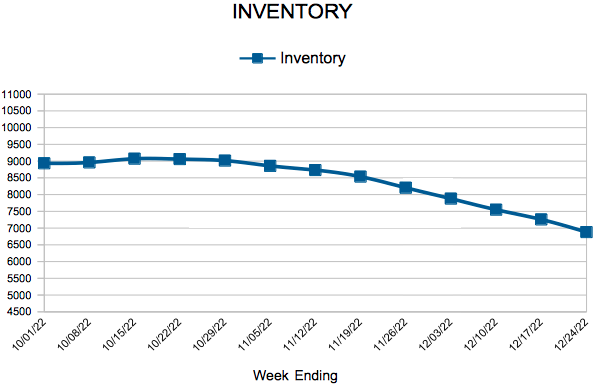

- Inventory increased 18.4% to 5,999

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.4% to $354,900

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.